Dan Gray

@credistick

Followers

3K

Following

27K

Media

1K

Statuses

13K

Head of Insights @equidam, the #StartupValuation platform // Writing at https://t.co/mlaeDB0Em9 // 📚 Library = Highlights

UK

Joined February 2009

@brandonhli @Airbnb Between 2012 and 2016 I mostly lived in Airbnbs. I was a huge fan of the platform, and have some great memories from that period. I no longer use it, at all. Just too many bad experiences, and stories like yours. Hotels all day. Never would have seen that coming. 🤷♂️.

38

99

7K

@JordanUhl @existentialfish Made no less comical by the fact that it’s about a former president who was elected on the promise that - amongst other things - he would lock up his opponent.

9

34

3K

The main reason "VC is hard" is because managers insist on it being an artisanal and entrepreneurial process rather than a financial service. Instead of developing best practices on portfolio construction, and following data to avoid biases or negative patterns, they talk about.

Most people dunking on VCs miss something crucial: VC partners are basically founders themselves. Here's why:. They raise funds from LPs just like founders raise from investors.- Need a compelling vision.- Face constant rejections.- Must prove their strategy works. They stress.

58

78

2K

@WritNelson It’s perplexing to see a game developer telling consumers not to raise their expectations. 😅. BG3 is what happens when a game studio executes on a vision they are passionate about, without needing to compromise. That’s it. That has been true from DOS1 to today. They earned it.

8

18

1K

@EddyVinckk Foreign nationals for whom these products are relatively much more expensive back home.

5

3

661

Imagine if VCs spent as much time considering and debating @jaminball's Misaligned Incentives article as they did with @paulg's Founder Mode? . The latter is an insightful look at leadership practices in high-performing startups, very well written — but ultimatley just

16

46

567

Why are so many startups pitching the same ideas?. This is the result of “startup catering”, where founders work on the problems they believe VCs care about, rather than problems they are connected to. It occurs whenever there is a strong and vocal consensus amongst investors

Honestly shocking how many startup pitches are nearly exactly the same. Building in a market thats saturated, similar product, similar GTM, etc. The number of companies building something that doesn't exist or that is truly unique is far less than 1%.

24

56

413

Should VCs bet on the 'horse' or the 'jockey'?. Broadly speaking there were three theories behind early venture investing:. • Tom Perkins (@kleinerperkins) focused on tech. • Don Valentine (@sequoia) focused on markets. • Arthur Rock (Davis & Rock) focused on people. This

24

30

336

@paulg I wonder if there was something that happened between 2019 and 2022 that would have kept people at home without much else to do?.

6

4

306

"VC isn’t what it used to be. The days of boutique firms elbowing each other aside for the best deals have been replaced by an elite cohort of GPs dictating rules and valuations." - @_RosieBradbury. In 2024, of all venture dollars raised:.• Andreessen Horowitz - 11%.• General

The concentration is already underway. The five largest US VC funds captured 44% of new funding in Q1. It’s difficult to frame that as returning to a healthy status quo. It’s worth considering the influence of a multi-stage brand name firm like Lux writing an open letter

11

48

290

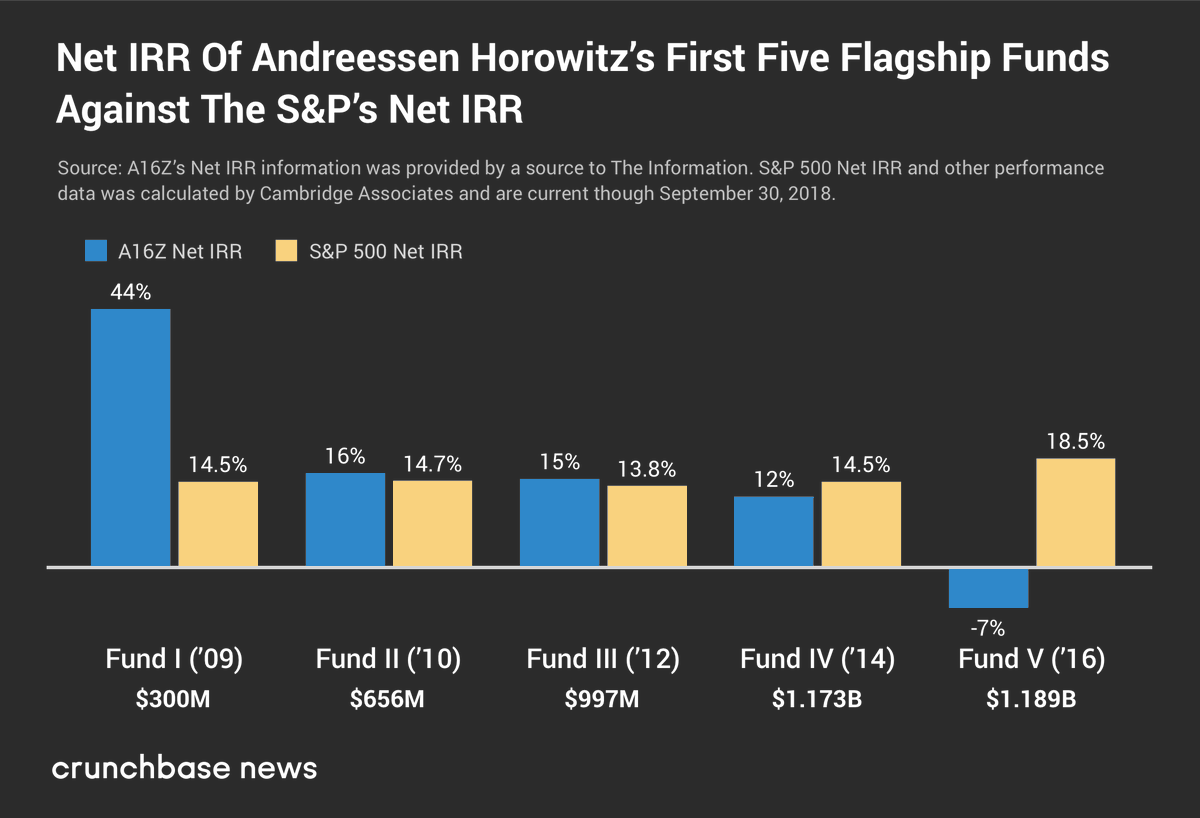

In 2009, @a16z raised a brand-defining fund. The plucky EMs — on a mission to steamroll the @benchmark model of VC — are believed to have delivered >5x for LPs from AH Fund I. Much of their founding story is at-odds with how the firm is perceived today:. Describing their

22

27

290

Venture Capitalists have a poor understanding of valuation, relying on past experience and signals to imply value. Thus, founders gravitate towards ideas that VCs are more likely understand, to reduce fundraising friction. Outlined in this paper by @EllenXiyueLi (more below):

8

33

231

"VCs cannot reliably pick winners. They can, however, construct portfolios that consistently generate great returns.". (source: "Picking Winners is a Myth"). LPs that underwrite seed funds to 5x, which <5% of GPs can actually achieve, are engaged in self-harm. In order to hit

@CamiloBAcosta @davemcclure The further out you push the target, the more you incentivise badly managed risk. You can aim for 3x and nothing prevents you hitting 5x, but if you set out aiming for a 5x you're more likely to overconcentrate or overindex on heat.

14

34

255

Revenue multiples will be looked back on as the weak-link in venture capital practices across ZIRP (and for some time after). Not only are they crude and procyclical, they favour companies with poor financial health — and occasionally outright fraud. Cook your books to add an

@jasonlk @HarryStebbings Stop using revenue multiples, and you will have more clarity on valuations.

9

22

201

YC appears to consistently outperform the venture market, indicating that @paulg and @jesslivingston cracked the problem of systematically funding great startups in a way that has outlived their direct involvement. As a contrast to weak performance and persistence in VC

YC isn't proud that it accepts such a small percentage of applications. We wish more of the applicants were good. Then YC could fund more startups, have more effect on the world, make more money, and spend less time reading applications per company accepted.

8

26

194

@BBCNews “They have estimated about 44 tonnes of fish will be ingested every year. For comparison, fishing vessels at Newlyn, in Cornwall, landed 1,700 tonnes in the month of July alone. So in a year, the nuclear plant will "eat" about a day’s catch.”. Change your headline.

1

1

180

@zachpogrob This sounds great, and I love Valve as a company, but… this might also explain why they haven’t really done much in the last decade?.

8

0

177

When "venture banks" compete against traditional VC firms, they can exploit a number of structural features to win on price, access, or both:. • Platform teams.• Signalling risk.• Networked GPs.• Operator partners.• Price insensitivity. Wherever a firm like @a16z

9

7

174

The central point of the post below is that risk is the product of venture capital, and some managers understand that better than others. Many of the replies talk about the futility of 'financial engineering', and how concepts like portfolio construction are less relevant to

The main reason "VC is hard" is because managers insist on it being an artisanal and entrepreneurial process rather than a financial service. Instead of developing best practices on portfolio construction, and following data to avoid biases or negative patterns, they talk about.

18

14

159

@ammaar How do you approach identifying, crediting and compensating all of the artists whose work it is using?.

5

0

143

@george__mack This one is easily explained:. There’s little incentive to report on preventable threats. It doesn’t drive clicks.

5

16

136

@WillManidis Power law is a smokescreen for all kinds of malpractice and many half-formed ideas in venture. That said, I’m not talking about financial engineering (outside of like proper portfolio math etc), but rather just a good grasp of the theory and familiarity with the data. Mostly.

3

3

124

@AnarchoAdmech Apple both catalysed and co-developed the USB-C standard, and moved their first device from Lightning to USB-C in 2018. Three years before the EU proposal.

11

0

118

@alliekmiller I need to see more examples of this to trust it. Right now it reminds me of the enthusiasm for no-code tools, before it turned out that they produced code that couldn’t scale.

2

0

118

One of the reasons that performance persistence is so weak in VC, and the cycles so agonising, is simply that knowledge doesn’t get passed on. We can look back at 2011 and see experienced investors like @bgurley talking about the danger of crude pricing in frothy markets, much

Bill Gurley: "When I first arrived at Benchmark, it was like, ‘Nothing can go wrong.’ There was an IPO every week. And then, wham! Man, the door came down hard.”

14

16

115

When "venture banks" compete against traditional VC firms, they can exploit a number of structural features to win on price, access, or both:. • Platform teams.• Signalling risk.• Networked GPs.• Operator partners.• Price insensitivity. Wherever a firm like @a16z

4

9

110

Allocation to smaller funds has continued to shrink, which is going to be a drag on the aggregate returns for VC moving forward. This is not a new problem. The share of capital absorbed by 'venture banks' has risen constently since about 2008. In parallel, the performance of VC

Venture is increasingly becoming a game of have and have nots. 30 firms raised 74% of total capital raised for VC funds this year with 9 of those firms raising 50% of the total capital raised. Emerging firms (defined as less than four funds) raised only 14% of total VC capital.

9

7

106

This morning, @chudson sent out a newsletter looking at the state of seed investing. Specifically, the difficult relationship between multistage firms and smaller seed funds. He laid out three scenarios which may emerge which I'll list here, but recommend reading his full

Over the past five years, the largest venture firms have played a lead role in the repeated boom-and-bust cycles of tech. Each time, these giants stoke the fires and use the heat to ratchet-up their AUM. Each time, it has been small ("more volatile") firms that paid the price

12

12

105

- The average return in VC is poor.- Small funds outperform large funds.- Successful firms increase fund size.- Thus (?) persistence is weak. This is the riddle of venture capital. As an LP, you can get NASDAQ-like returns from a giant firm, or you can do the work to juggle.

That is true. Unlike Private Equity, VC is not an asset class that can be indexed (at least not if you want to beat PE in term of returns). Fund selection and access is key. .

4

10

105

@sairarahman "My mind is immediately attracted to optimising everything, and I think that if you really give into that kind of addiction that you lose the joy of the small things. The minutiae of life." - @lexfridman .

0

3

101

@hiltonholloway You’re complaining about a guy who was helping to fight a fire amidst an angry mob, wearing a jersey with the Union Jack on it?. You’re likely a greater waste of space than he is.

9

2

84

@burkov It’s machine learning, not “AI”. AI has become a meaningless catch-all term for just about anything with an algorithm.

17

0

84

The bar for 'calling venture capital a Ponzi Scheme' was a lot lower in 2011 than it is today. The problem, highlighted by @ZelkovaVC in the article below: as existing investors increasingly led pricing on subsequent rounds, they ran into a conflict of interest. Essentially,

9

11

91

Many VCs stopped doing the hard work of identifying transformative innovation a long time ago. Instead, they just manufactured successes by weaponising cheap capital. Thus the run of micromobility/rapid delivery/web3/etc nonsense. All while great founders/ideas went unfunded.

Juicy rainy day read: Venture Predation. Thanks to the copious amount of VC thought leadership over the past decade, we have plenty of empirical evidence confirming that much of the theory laid out here was, indeed, intentionally pursued in practice

4

21

88

@jmj The closest I came to something like that. Based on imperfect data, with limitations — but interesting outcomes nevertheless.

2

10

88

@andrewchen The best people to hire in pretty much any field have a limited social media presence, because they are busy working. Judge them on work done.

3

0

85

@bgurley There is no appetite for the bloated consensus deals of the last few years. Weaponising capital in hot markets is a dead strategy, at least for now. Prices fell when the bubble burst - and are now stabilising. It is as good a time as any to invest. Early stage firms will keep.

7

4

83

@minchoi No, they can’t. They can make wonderfully aesthetic but completely incoherent montages, built on a mish-mash of other people’s ideas.

0

1

72

@annaarthoe You're out of touch. To people outside of the AI hype-bubble, this is creepy and dystopian. It watches what's going on in your life and comments on it? No thanks? . There's no clear value. It's just a slick advert for a product riding the coat-tails of a dying trend.

2

1

77

Great to see @RevolutApp keep raising the bar for what a traditional banking alternative can offer. (Referring more to the premium plan, but the card is nice too!) #Fintech #Payments

4

9

75

This is a great post by @Samirkaji, which corrected some of my own 'small firm vs large firm' thinking. - Multi-stage firms are raising from different LPs, with a very different return profile. They are not in direct competition with smaller firms on that basis. - They don't.

The LP debate of large VC firms versus small VC firms is largely irrelevant and misses the main point that they are fundamentally different economic products today. The issue is that we view the entire industry through the legacy classic definition of Venture Capital versus.

9

10

73

@gmpolice Where in your SOPs can I find "head stomping", and when should it be applied to tasered individuals that aren't an active threat?.

5

5

64

Please stop using “tier 1/2/3” for VC. These labels do not reflect performance and only really benefit incumbents. Many “tier 1” firms have become complacent compared to “tier 3” firms that rely on returns. There are good VCs and bad VCs, that’s all. Shout-out to @NWischoff

Never raise money from Tier 3 VCs. Every horror story I hear is from uncalibrated VCs that have no operating experience who think they can tell a founder how to run their company.

5

7

66

Venture capital is supposed to finance founders with risky ideas. Innovation. Progress. Instead, capital has been torched trying to manufacture winners in categories like web3, rapid delivery and micro-mobility. All while household names in VC pontificate on shaping the future.

A new paper titled "Venture Predation" argues the classic Silicon Valley model of venture capital is "anticapitalist. It's illegal. And it should be aggressively prosecuted, to promote free and fair competition in the marketplace," reports Adam Rogers.

4

19

61

"The hit rate of VC investment didn't get meaningfully better in the boom time - so shutdown stories will keep coming.". Should increasing the volume of capital in venture generally produce better or worse outcomes? . There are two stories here:. 1) Well capitalised ecosytems.

We (ie US VCs) funded so many companies in 2021 and late 2022. We should be unsurprised that many of them are now shutting down, even those that raised $20M+. The hit rate of VC investment didn't get meaningfully better in the boom time - so shutdown stories will keep coming.

2

13

65

@hassano_82 @HarryStebbings And VCs disproportionately fund founders from their alma mater, which means they’re not prioritising identifying outliers. It’s a game of relationships and velocity of capital. Literally toxic to returns, but it has taken years for people to start recognising that in the data.

3

3

59

@buccocapital Sure, they've made changes which encourage people to stay on X. As has every other platform. Also. • The new analytics are better.• More features for creators.• Addressing systematic manipulation.• Solving the economics of the company. I'm not sure why you are so salty.

7

0

55

@JeffreyWShapiro Working from home is working remotely. Working remotely isn’t necessarily working from home.

0

2

57

@yeetgenstein Remember all those viral posts where people would make a Midjourney/DALL-E image increasingly extreme based on the number of likes it got?. Yeah, I’m thinking it’s that.

1

1

53

@un4w4r3 @waitbutwhy My theory is that everyone reclining is actually a net loss of comfort. It’s actually worse for us. The option to recline is a ploy by airlines to make us feel like we are responsible for our own level of comfort.

2

0

58

@tegmark Point 1 is just a meaningless platitude, because concentration is the obvious outcome of 2 and 3. 2 and 3 are exactly what Yann says your position is.

2

1

54

How have the largest 10 Venture Capital firms in 2024 grown over time? . I answered this question by looking at data (primarily from @Crunchbase, with manual research to fill some gaps. Two things stood out:. 1) 2023 appears to have been a year of consolidation through

4

5

57

@whyvert This is partially a measure of technical literacy or accessibility, rather than purely a test of honesty.

0

0

56

@sugabelly @seyitaylor There was plenty of misinformation coming from verified sources before. If you want a trusted, up to date feed of information, then follow the right people. More importantly, X Premium helps suppress systematic manipulation of information on the platform at times like these.

9

1

51

@DrChrisCombs Cool companies, but I don't think any can claim to have achieved a fraction of what SpaceX has in the last 20 years - and many of them are riding directly on the success of SpaceX.

8

1

51

@0xRaghav VC is so difficult because investors hamstring themselves by pretending to be entrepreneurial. Instead of developing proper portfolio construction and learning what drives success, they invest based on biases like consensus — which is literally the opposite. If they acted more.

2

3

56

@ralessan1 "Historical data from varied sources indicates that Seed funds should be diviserified across 80+ investments.". "Yeah but Benchmark doesn't do that.". "You are not Bill Gurley, and it is not 1995.".

1

1

52

@auxiliaryarmy @zallarak @ID_AA_Carmack Writing to optimise for attention, rather than to simply tell a great story, is how you get vapid thrillers and trash fantasy.

3

0

48

@vc My problem with this feedback is that they are focusing on symptoms, not problems. "Your ARR is meaningless and your valuation is too high" is the wrong conclusion. Instead, it should say "We have concerns about your PMF and unit economics which you haven't addressed".

4

0

49

And the reason for this?. Too many VCs cling to dogma, anecdotes and herd behaviour. Their strategy for delivering returns is akin to gambling. Instead, they could be building properly risk-optimised portfolios, following the data, and finding value in overlooked opportunities.

The power law in venture capital applies to VC firms themselves, not just startups they invest in. >95% of VCs are absolutely useless or clueless. But the top 1-2% of VC investors are the sharpest people you’ll ever meet.

5

3

51

@Object_Zero_ @QuantumDom I think it’s safe to presume that this is a map of meth labs that were found and shut down. So to an extent it’s also a map of police competence.

0

1

48

@Carnage4Life The CEO of Rabbit has not hidden from this fact. He admitted in coverage prior to launch that it’s only a hardware product to inflate switching cost. And people still bought one? 🤷♂️

4

2

46

A lot of the activity in 2021 and 2022 was predictably foolish. For LPs, hot markets are dangerous because capital gets blown on consensus. This is amplified when they invest in EMs with poor discipline and heat-seeking thematic funds that end up overly-concentrated.

2024 funding to venture capital firms declined significantly, now back to 2018 levels; new VC’s are the hardest hit

4

7

50

@Molson_Hart It's unclear how well the post 2020 cohorts have done, but certianly up to that point Y Combinator was still doing very well.

2

3

48

@Jason @reidhoffman @linakhanFTC It’s always fun when you go on a full caps rant, @jason. The last time was the wake of SVB, when you were ranting about buying fuel and ammunition, I think?. VCs have broken venture. Not Lina Khan. M&A is marginally up, IPOs are still fucked after VCs cooked the market in 2021.

3

6

45

@TimothyDSnyder This is a monumentally silly perspective. Musk had provided critical communications infrastructure for Ukraine’s resistance, but that’s not enough for you unless it has an associated body count?. Musk is allowed to draw moral lines on how it is used, and you should support that.

4

1

44

People ought to understand the value of a purely ornimental head of state:. The Royals absorb all reverence for tradition and authority so the political class can be correctly scrutinized. Yes, it's an odd pantomime. But it works, and we like it. It's also good for tourism.

It goes without saying this is farcical, wasteful and embarrassing - and it’s high time Britain’s democracy grew up.

0

1

42

The passage below, from @kahneman_daniel’s article “Don’t Blink! the Hazards of Confidence”, should connect with anyone in VC. Kahneman’s work on how bias and ego influence decision making — particularly in investment — provide a solid foundation for a hypothetical VC

6

2

47

Both VC and startup investment returns have a power law distribution, as so much (poorly diversified?) fund performance is driven by a minority of outliers. Many principles for risk management in VC (e.g. @AngelSpanInc's "Process Alpha" paper) can help GPs manage "power law"

5

6

47