AmadeusValue

@AmadeusValue

Followers

3K

Following

555

Statuses

468

Long-only PM investing in GARP and special situations globally.

Sydney

Joined July 2010

@1MainCapital Hi Yaron - has there been any confirmation over which judge will preside over the new court case? Feels like a Repub-appointed judge would naturally be more inclined to support $PRKR here

0

1

1

RT @Benioff: Deepseek reshines the spotlight on the true treasure of AI: it’s not the UI or the model—those are just commodities. The real…

0

107

0

Has been an interesting 48 hours in understanding which accounts to follow or not

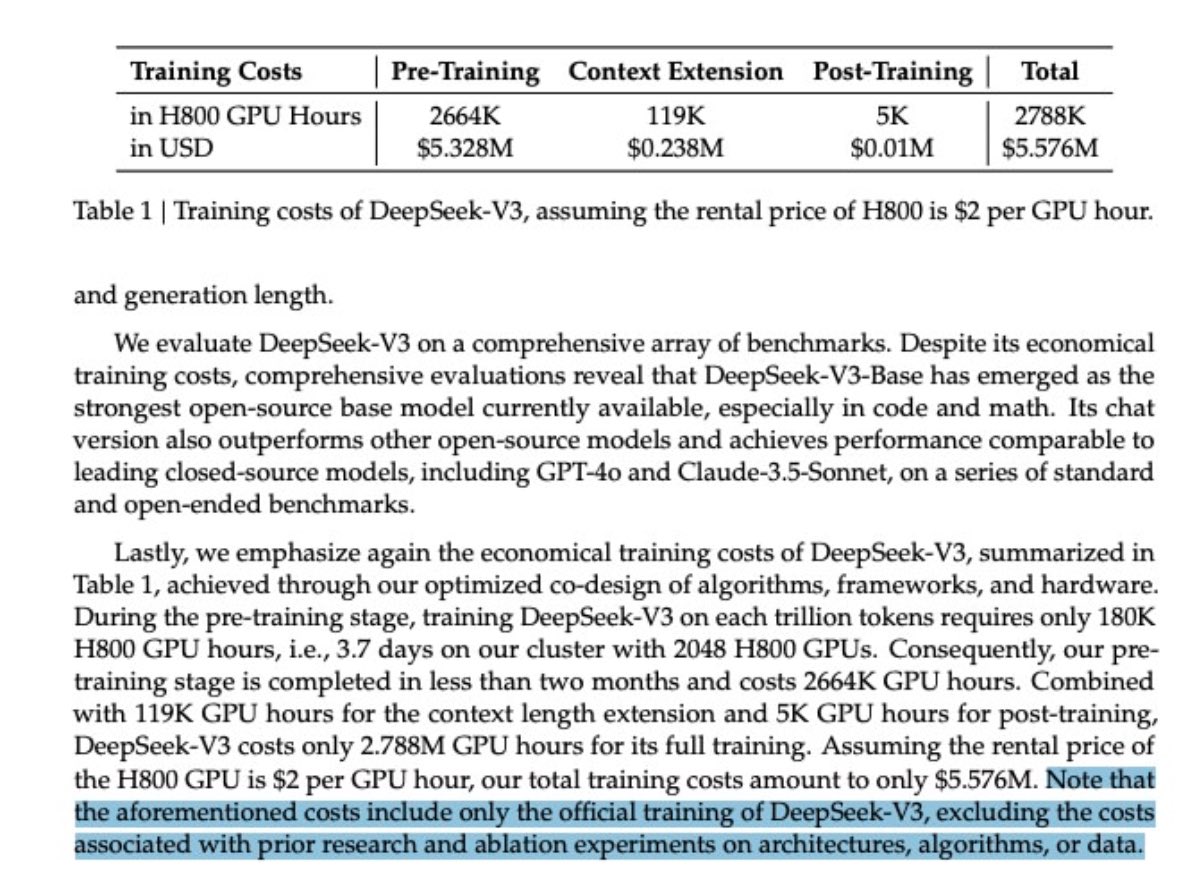

Ex-costs for research, ex-costs for iterative testing of different designs, algorithms, architectures and data. It seems like EBITDA hypothetical accounting. But everyone running around still saying they did it for $5.6 million. Did anyone actually read the DeepSeek paper? Never mind none of this is verified info re: training or pre-training cluster. The internet never lets the facts get in the way of a good story

0

0

3

Anyone have any theories on why the $CRM CFO is exiting after only four years on the job?

Salesforce $CRM looks v interesting. I have it on a eFCF yield of >5% 1YF for a company which should grow eFCFPS at a ~19% CAGR for the N5Y. What are the bear arguments? Can paint >15% N5Y IRR's on conservative assumptions: 1. >11% sales growth from a cyclical rebound, AgentForce roll-out, DataCloud cross-sell. Unflexed pricing power here too (increased pricing by +9% in FY23 and only saw a +70bps increase in customer attrition) 2. EBIT margin expansion from c30.5% to 38% from a combination of continued GM accretion, AI efficiencies, operating leverage and a discrete reduction in S&M 3. >85% of eFCF generation going into share buybacks Leads to a N5Y eFCFPS CAGR of ~19%. IRR's lower as assume exit multiple of 25x eFCF.

1

0

1

RT @ArmsGarrett: $BFF.MI mkt cap is €1.4B at €7.50. YE tangible equity is 825M, so 1.7x. The company will run a 30%+ ROE & continues to tar…

0

1

0

Salesforce $CRM looks v interesting. I have it on a eFCF yield of >5% 1YF for a company which should grow eFCFPS at a ~19% CAGR for the N5Y. What are the bear arguments? Can paint >15% N5Y IRR's on conservative assumptions: 1. >11% sales growth from a cyclical rebound, AgentForce roll-out, DataCloud cross-sell. Unflexed pricing power here too (increased pricing by +9% in FY23 and only saw a +70bps increase in customer attrition) 2. EBIT margin expansion from c30.5% to 38% from a combination of continued GM accretion, AI efficiencies, operating leverage and a discrete reduction in S&M 3. >85% of eFCF generation going into share buybacks Leads to a N5Y eFCFPS CAGR of ~19%. IRR's lower as assume exit multiple of 25x eFCF.

1

3

16

@rubicon59 Multiple will stay cheap until clarity on Trumps intention with Gaza and Ukraine conflicts. If both solved promptly we will see a big drawdown here.

0

0

1

$SNX reporting today. Hopefully will see a continued rebounding in billings growth, although US may be weakish due to an IT spend 'air pocket' pre-election. Eyes on more details re Hyve (growth rate, margins, backlog) as well a restart of the SBB after paying down a note last Q

$SNX's Hyve segment looks like a seriously attractive 'hidden asset' AI beneficiary. What is the pushback to owning $SNX here? I'm assuming mid-teens top-line growth out to FY26e in line in line with the recent past (conservative as they are rapidly winning new hyperscale customers). That would equate to ~$7.2b sales. On an assumption of a 5.5% EBITm, that is $400m of FY26e EBIT. Peers like Quanta Computing $2383.T, Hon Hai Precision $2317.T and Pegatron $4938.T all trade on 1YF EV / EBIT's of 8.5-10x. Given $SNX is US-based and thus a benefit of re-shoring, is it unrealistic to assume it would trade on 11x? If so that is ~50% of the current market cap.

2

0

4

$SNX's Hyve segment looks like a seriously attractive 'hidden asset' AI beneficiary. What is the pushback to owning $SNX here? I'm assuming mid-teens top-line growth out to FY26e in line in line with the recent past (conservative as they are rapidly winning new hyperscale customers). That would equate to ~$7.2b sales. On an assumption of a 5.5% EBITm, that is $400m of FY26e EBIT. Peers like Quanta Computing $2383.T, Hon Hai Precision $2317.T and Pegatron $4938.T all trade on 1YF EV / EBIT's of 8.5-10x. Given $SNX is US-based and thus a benefit of re-shoring, is it unrealistic to assume it would trade on 11x? If so that is ~50% of the current market cap.

TD Synnex $SNX looks interesting heading into FY25e - I've got a FY25e eFCF yield of 8.6% / PE of 7.7x. The company has re-affirmed it will be allocating >90% of eFCF into share buybacks. The company HAS become a share cannibal and at this SP can reduce it's float by 50% over the next five years. Top-line growth has rebounded, and there is optionality in spinning out / selling Hyve, its ODM segment, which on conservative estimates is worth 30% of the company's EV despite contributing 15% of group EBIT. It's mispriced because despite Hyve (as a massive stealth AI DC build-out beneficiary) being higher margin and growing faster than the group, it has temporarily depressed margins due to on-boarding hyperscale customer and will lead to a slight WC build. Although, value added distributors have traded on cheap multiples forever. I see path to 15-20% IRR's over the next five to ten years, even in the absence of discretely monetising Hyve. Would love to hear thoughts if any.

0

0

6

@VB4alpha Unlikely in the very short term. Italian SME's will be the last sort of customer to uptake AI applications.

0

0

2

@Stanley_invest Yes my assumptions factors in a slight WC build for this year. CCC days are at normalised levels.

0

0

0

@niubi1988 Lower efficiency ratio and generally skeptical of PE IPO’s. Huge overhang from Platinum too

0

0

1

Thanks. Had a look at $ARW, it's interesting, but is facing disintermediation in its Semi distribution and share losses (to $SNX !) in its value-added distribution biz. They should sell / split the segments. Could do well though as levered to a recovery in industrial semis. I prefer the pure-play IT exposure personally.

1

0

3