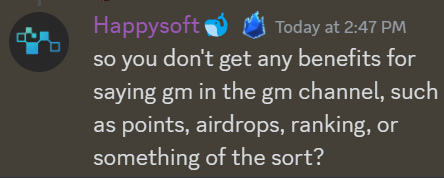

Durden ∞⧖

@durdenwannabe

Followers

8K

Following

26K

Media

531

Statuses

6K

Kicking ass @Lifinity_io @sandglass_so

Joined May 2021

Jupiter already has a vibrant community 🪐. I'm excited to help turn that community into a well-functioning DAO that will move not just Jupiter but the whole Solana ecosystem forward 🫡. LFJ!.

Today, as part of our J.U.P rollout, we are excited to introduce Jupiter Working Groups (JWGs) – independent groups of operators who will focus on growing the Jupiter community, enhancing the Solana ecosystem, and facilitating DAO coordination! 🥰. Given that this is a new.

38

41

352

Not everyone knows that Lifinity runs a @jito_sol validator with 379,292 SOL of stake. Today we received an offer of $40k per month to onboard to a newly created mempool. That's ~2,526 SOL per year (~0.7% APY). Apparently they already have 2M SOL of stake. We declined.

34

22

267

Trading on @JupiterExchange not only gives you the best price. It also gives you access to @PythNetwork's $PYTH airdrop by routing to DEXs using Pyth such as @Lifinity_io and @GooseFX1. Traders swapping on a single DEX in shambles.

16

50

192

The worst case time it takes @JupiterExchange's Metis algo to calculate the optimal trading route across all DEXs on Solana is faster than the best case time it takes Uniswap to find the optimal route on just Uniswap. That's some god tier shit right there

6

42

201

Yo @DefiLlama why do I gotta click "More chains" and type "Solana" to filter for it?. Super inconvenient. Solana does more volume than any option listed there, so it only makes sense that it be listed first

20

17

186

We are proud to announce that The Solana Update has rebranded to The Solana Grapevine! 🎉🥳🎉. As you may have guessed from the name, with this rebrand we are officially joining the @grapeprotocol family 🍇 #itsGrape

6

34

178

ETH-USDC liquidity is better on Solana than on Ethereum for medium size ($10k), even before accounting for the difference in fees! . @JupiterExchange vs @matchaxyz vs @1inch

7

45

166

Is LFNTY the first pre-FTX Solana token to go back above its IDO price?. @Lifinity_io's veIDO price depended on the user's lock period chosen, ranging from $0.42~$0.84 with an average price of $0.48

16

21

153

I read @MagicEden's most recent newsletter & was rather disappointed with its rhetoric for honoring royalties. I'm also dissatisfied with how @YawwwNFT didn't take their argument for users choosing royalties to its logical conclusion. A third perspective 🧵👇.

20

62

158

Last November, I joined the @Lifinity_io team. Lifinity is revolutionizing the DEX space in terms of efficiency, profitability, and tokenomics. A thread 🧵👇.

5

34

150

New @orca_so just dropped. Pretty disappointed. Largely a psyops designed to get retail to trade on their platform rather than @JupiterExchange. Crucially, contrary to claims made prior to launch, Jupiter still *always* outperforms their new routing engine. 🧵👇

12

32

148

🔒 JUP Airdrop Lock Boosting 🔒. What if @JupiterExchange could know which airdrop receivers will hold on to their tokens rather than sell them as soon as they unlock?. Wouldn't Jupiter want to reward those users with more tokens?. There is a way 🧵👇

17

29

134

Yo @blknoiz06 appreciate the @Lifinity_io shoutout on the recent @UnlayeredPod podcast 💙. Not sure how familiar you are with Lifinity, but capital efficiency is just the tip of the iceberg of things that set Lifinity apart from other DEXs. 🧵👇

7

32

139

Even during this volatility, you can buy ETH up to $30k more cheaply on Solana than on Ethereum (even before considering fees!). @JupiterExchange vs @DefiLlama (both aggregators)

11

29

118

For the first time @Lifinity_io's NAV hit $11M since the market crashed, which is more than the $9.6M + 15,000 SOL that was raised 💪. On top of that, since inception a total of $1.8M of revenue has been distributed to veLFNTY holders 🤌

12

18

108

Hey @0xngmi maybe you guys have a reason for not including Solana at the top, but if so I don't know what it is and I'm genuinely curious to know why.

Yo @DefiLlama why do I gotta click "More chains" and type "Solana" to filter for it?. Super inconvenient. Solana does more volume than any option listed there, so it only makes sense that it be listed first

21

7

110

Excited for Jupiter Start and how it's getting the community involved in the process, just like they did with the JUP airdrop 🪐. Would love to be a part of vetting projects and their tokenomics and help grow the pie! 🥧.

"Grow The Pie" Update 2: Jupiter Start. At Breakpoint, we presented 3 major initiatives to grow the Solana Pie: $JUP, Jupiter Start, and Jupiter Labs. Today, after extensive discussions with the ecosystem, we are delighted to elaborate more about Jupiter Start. For a long time,.

6

8

89

A reminder that you can accumulate ETH more cheaply on Solana 🫡. And liquidity is only improving over time 🔥. Jupiter vs DefiLlama (both aggregators)

Even during this volatility, you can buy ETH up to $30k more cheaply on Solana than on Ethereum (even before considering fees!). @JupiterExchange vs @DefiLlama (both aggregators)

6

17

101

Flare DAO currently has a 2,500 SOL bid on Tensor for its own collection. If this SOL was staked, the staking yield could buy back a Flare every 12 days. This strongly incentivizes Flare DAO to remove most of its liquidity from Tensor. Please make this a priority @tensor_hq

If NFT AMMs & marketplaces began supporting staked SOL tokens (mSOL for example), liquidity providers would earn staking yield on their mSOL even as it remains idle as a bid or part of an LP position. In this world, would you place bids & provide liquidity in SOL or mSOL?.

9

12

105

A collection of LP chart porn. Courtesy of @Lifinity_io. These charts compare the performance of the pool vs just holding a 50/50 portfolio. Starting with the highest volume pool. SOL-USDC v2

12

24

103

Meanwhile, Lifinity:. ・No VCs.・Initial float of 20%+.・Starting MC of ~$17M.・Team vesting schedule of 4 years.

Crypto fundraising is characterized by short vesting schedules, absurdly high valuations, and very low initial float. This has become the norm, and together these factors represent a time bomb. VCs played a major role in shaping this norm. For reference:. - Crypto VC: 3-12.

8

11

96

Amazing article by @semajeth on the perils of being an LP on CLMMs (Uniswap v3 style AMMs). It's quite long, so I extracted the most salient points for your convenience. 🧵👇.

3

25

97

The market has rediscovered @lifinity_io's veIDO mechanism from over 2 years ago:. ・Capped vault.・Timing of deposit doesn't matter.・Lock your allocation to get a cheaper price.・Refuse to pay CEXs to get listed. This is the way 😎.

How we're making $CLOUD the greatest launch yet. I wanted to talk about how we're working to design the LFG launch to make the $CLOUD launch truly great: as liquid, fair and aligned as possible for everybody. A great launch must be liquid. The baseline of any great launch is

5

15

99

In today's update. ・SamoTIPS.・Grape Access Opens to All.・Saber x Coin98 Wallet. and more!. #Solana @samoyedcoin @CropperFinance @hydraswap_io @ArmySatellite @solanagrape @Saber_HQ .

2

17

79

So @SaberProtocol recently changed its fees from 0.001% to 0.01%. This is a 10x (!) change that is positive not just for Saber but also for all other DEXs with stable pools 👀. A lil' history 🧵👇

5

20

89

Now imagine the locked BONK could be tokenized the way max-locked veLFNTY can be converted to xLFNTY and traded. I think this would be a win for all parties involved. Lmk if the teams want to discuss.

Introducing BONKrewards by @ArmadaFi. Lock your BONK to earn rewards from Community built BONK Eco products like BonkBot, SVB, and BONKswap. Success of participating BONK Ecosystem Products = more rewards for users who Lock their BONK, with boosted rewards from the pool for

9

11

89

Dear @solana. For the next hackathon, please separate the tracks for Payments and Finance (DeFi). I'm sure I'm not the only one who wants to browse DeFi projects but have to wade through a ton of payment projects. So cumbersome I just gave up, will wait for others to find them.

7

5

81

♾ Lifinity Tokenomics PSA #2 ♾. "Top 10 holders have 98% of supply? Lifinity has TERRIBLE tokenomics.". Or perhaps the top 10 list fails to provide a clear picture. Let's start by asking, who exactly are these addresses?. 🧵👇

@durdenwannabe @AnotherCryptoM1 @orca_so @RaydiumProtocol @Lifinity_io The fully diluted market cap is very big especially compared to a small holders amount. Top 10 holders hold 98% of all supply. These are huge red flags. I still hodl some Lfnity though, because I like the project itself. But the tokenomics needs fundamental imrovments

11

22

82

Recently, @orca_so reached out to one of @Lifinity_io's partners, asking them to not make a market making deal with us. They claimed that Lifinity would have a negative impact on their token's on-chain liquidity depth. This is wishful thinking at best 🧵👇

4

26

84

Banx is making it happen 🔥. Honestly it's a no-brainer, and once one project does it, gains a free competitive advantage from not missing out on Solana's native staking yield, and users see the light, all other projects will have to follow suit. You love to see it.

Flare DAO currently has a 2,500 SOL bid on Tensor for its own collection. If this SOL was staked, the staking yield could buy back a Flare every 12 days. This strongly incentivizes Flare DAO to remove most of its liquidity from Tensor. Please make this a priority @tensor_hq

13

21

86

Think this makes a lot of sense as a memecoin launch model. ・Team gets no allocation.・But team gets the fees from the perma-locked liquidity.・Users more willing to buy because team can't dump.・Team is incentivized to build so that people speculate → generate volume → fees.

1/ Today, Meteora expands its LP army to include memecoins! We've generated millions in LP fees for token launches, and, for memecoin creators we now allow you to compound and claim fees on permanently locked liquidity, for all time. 🔥.

7

11

85

Reminder that @JupiterExchange:. ・Rewards you for swapping.・Charges no fees.・Gives you the best price among all DEXs. Swapping anywhere else is pure cuckery.

4

7

84

I've never gotten the sense that Solana is pushing forward because they feel pressure from the "next Solana", the way Ethereum seems to feel pressured by Solana. Solana has simply stayed true to it's original vision, and mind you that's from before any "Solana killers" existed.

3

5

78

Been seeing a few misconceptions about this dashboard. 1. Only Protocol Earnings accrue to the protocol, not Total Earnings.2. Token emissions used to generate the earnings (i.e. the costs) are not included. What really matters is PROFIT. 🧵👇

This dashboard enables earnings comparisons between NFT projects, marketplaces, DEXes, and infrastructure protocols like Helium and Hivemapper. In the DeFi category, the top projects are .1. @orca_so .2. @RaydiumProtocol .3. @JupiterExchange .4. @Lifinity_io .5. @Kamino_Finance

9

18

77

I recommend not using the "JupiterZ Only" option. Gasless and 0% slippage are not meaningful because they are only part of the equation, and what ultimately matters is the final price you get. As a trader, you should simply want to trade where you get the best price.

Delighted to announce that JupiterZ is finally live!. With a unique RFQ model designed specifically for Solana, enjoy gasless swaps and 0% slippage with a single toggle 👌. All swaps will pick the best price between our routing engine and RFQ for max convenience to all users.

11

12

76

Solana wasn't designed "to be contrarian to Ethereum" or "exist as a reaction to Ethereum" as claimed. It was designed from first principles to be maximally efficient. And that efficient design just happened to diverge from Ethereum's, which wasn't designed with that goal in mind.

8

14

69

I've said this before, but isn't Phoenix by @ellipsis_labs a clear improvement on OpenBook?. What's the point of continuing to incrementally work on OpenBook's technical debt?. Phoenix doesn't even have a frontend and is already regularly doing more volume than OpenBook.

Things are getting spicy!. Contribute to OpenBook at and have the Foundation match it with money that @Austin_Federa had previously earmarked for @therealchaseeb’s severance package!.

18

5

65

38% organic yield distributed in USDC is quite high, higher than you can get on stables. And that's just trading fees – market making profit (buying low and selling high), which goes to increase the book value of LFNTY, is not even included 😎

Our next round of protocol revenue has been distributed! ♾. LFNTY was below book value, so we used a portion of the funds allocated for increasing liquidity to purchase 85,258 LFNTY and bring it to its book value 📗. Since we purchased undervalued LFNTY, this resulted in

7

10

72

The rev distribution / token value accrual narrative is ramping up. Meanwhile, Lifinity has been front running it for nearly 2 years. Also, here's some alpha: the announced revenue figures don't include market making profit (MMP) 😉.

Our next round of protocol revenue has been distributed! ♾. 68,218 LFNTY & 108,056 USDC has been added to our LFNTY-USDC pool.

4

13

73

Projects tend to like buybacks since they visibly pump the token on the price chart. Users tend to like distribution because they don't have to sell to share in the profit. There's a little-known top 10 DEX across all chains that distributes revenue.

Our next round of protocol revenue has been distributed! ♾. Once again, we have set a new record for monthly revenue 🔥. 517,754 USDC has been added as concentrated liquidity to buy LFNTY 🫡

7

18

76

Highly encourage anyone asking this to try the same comparison for *insert favorite token*. LFNTY still has one of if not the best book value to market price ratios among all assets on Solana. For most assets, it's not even close. So many with a book value of $0 and a ratio of ∞.

@Lifinity_io Why are we 4x book value?.

6

12

70

This is the route @Lifinity_io took. The main thing that a CEX listing accomplishes is a temporary price pump; it doesn't create long-term value and eats into the team's funding. All of Lifinity's liquidity is on-chain & the vast majority is protocol-owned so it's permanent.

instead of trying to get listed on centralized exchanges at high fdv, resulting in airdrop farmers, marketmakers, and vcs dumping on buyers, painting a v ugly price chart. why don't more teams just launch their tokens on dexes at low fdv, like in the old days, let price discovery.

3

14

65

.@Lifinity_io would like a word with you.

The narrative of Solana’s volume surge on Friday was it was enabled by OPOS (only possible on Solana) defi tech allowing for very high capital efficiency. In reality the comfortable majority of the volume was Orca and Raydium, vanilla AMMs with the same mechanism as Uniswap.

3

10

66

"It buys more when prices drop and less when they rise.". Fun fact: this is what @Lifinity_io's buyback bot has been doing for years 😎.

Introducing Value-Average (Beta) -- it enables you to auto-invest based on price action! 🚀. Check it out at It’s hard timing the market, value average can help with that. Value-average (VA) prioritizes balanced portfolio growth by dynamically adjusting

4

7

65