Jeremy Schwartz

@JeremyDSchwartz

Followers

20,271

Following

2,478

Media

1,553

Statuses

8,908

Global Chief Investment Officer @WisdomTreeFunds . Host of Behind the Markets @SXMBusiness Powered by @Wharton @SiriusXM 132

Philadelphia, PA

Joined October 2011

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

BAMBAM

• 256932 Tweets

#BLEACH

• 195503 Tweets

Pete Rose

• 165498 Tweets

PlayStation

• 151283 Tweets

JO1 WHERE DO WE GO

• 77068 Tweets

Happy New Month

• 67027 Tweets

Jimmy Carter

• 61784 Tweets

#ไฟไหม้รถบัส

• 61397 Tweets

#LINEマンガガチャ

• 55817 Tweets

Goff

• 38243 Tweets

सोनम वांगचुक

• 37242 Tweets

Independence Day

• 29538 Tweets

コーヒーの日

• 26248 Tweets

都民の日

• 19931 Tweets

KerjaJOKOWI PRABOWOlanjutkan

• 16227 Tweets

YukBARENG MajukanBANGSA

• 15539 Tweets

Pancasila

• 13287 Tweets

世界4位

• 10870 Tweets

夕刊フジ

• 10229 Tweets

Last Seen Profiles

As someone who talks to him live every week on the record and on air—this was as fired up as I’ve seen him..

And he’s been spot on this entire inflation cycle-so I wouldn’t bet against him being right now too…

26

25

319

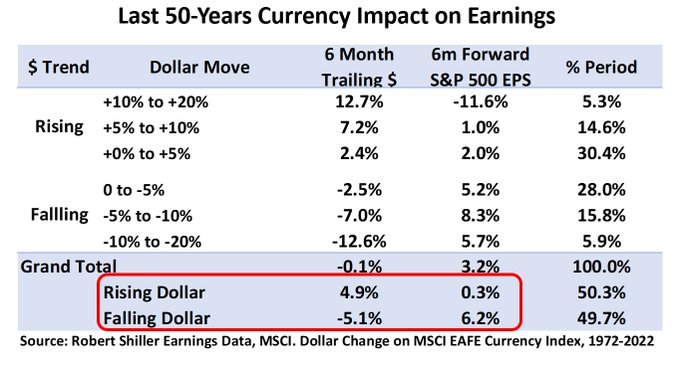

Is it time to get long EM?

Join our space Monday 5pm EST with

@seemacnbc

co-hosting a discussion with

@MatthewsAsia

portfolio manager Michael Oh, WisdomTree China expert

@liqian_ren

and India expert and friend

@_Gaurav_Sinha

.

3

24

143

Sheila Bair to CFA event: “European banks are in better shape than US banks to my embarrassment.”

She gives credit to

@ecb

stress tests being more stringent and better than

@federalreserve

stress tests particularly calling out tests sensitive to inflation, rates being better

4

31

121

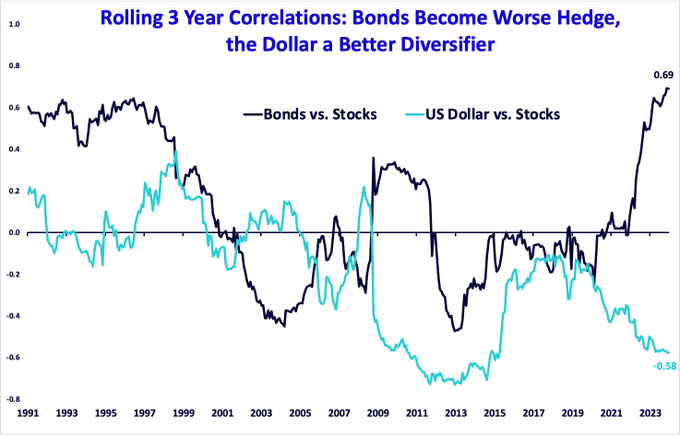

Coming soon (expected 12/20 list date):

WisdomTree Bianco Total Return Fund (ticker WTBN) – tracking the Bianco Research Fixed Income Total Return Index.

We’re excited to be collaborating with

@biancoresearch

on this new ETF!

9

18

98

BTW hot new cover art for this new edition now on Amazon pre-order. Some personal news included 🤗

15

10

94

We have Prof Siegel on stage right as Fed is announcing latest policy at CFA event

“Failure to regulate banks as big of failure as calling inflation transitory” and the tightness in credit lending is equivalent to 3 or 4 hikes….

@CFAinstitute

9

7

81

“There’s going to be two more rate hikes -no one cares about your lack of housing inflation cold takes”

- “No, there will be 3 more hikes”

-CampKotok Sunday night deck talks

@SamuelRines

@biancoresearch

@DiMartinoBooth

@Interdependence

15

10

74

Twitter fam-my daughter needs your help.

The most likes gets a free skateboard. Can you help her out here?

@FutureProofAC

@Vetta_Fi

6

3

79

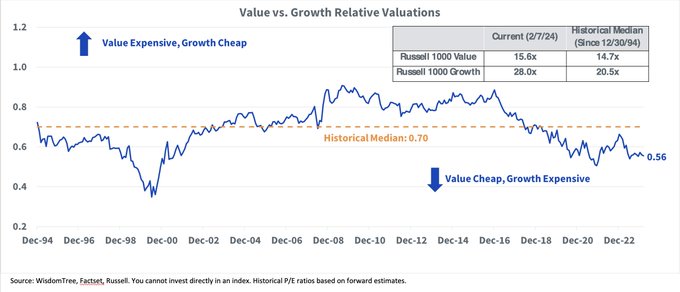

This would probably stack up as the most contrarian trade out there... trading into small caps vs the Nasdaq, at extreme wides and only parallel to 99 top in tech; by

@jkrinskypga

at

@chartsummit

cc

@JeffWeniger

7

19

72

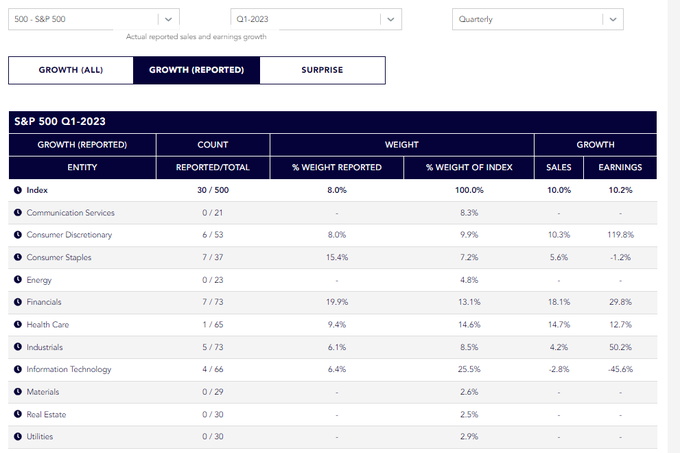

We are up to 81 companies reported in our Earnings Path tracker this am.

S&P 500 sales: +7.4%, earnings -1%.

But 'surprise' : sales up 1.6% more than analysts estimated; EPS 6% beats.

Consumer Discretionary surprise +20%.

Link for daily updates

7

8

72

Twitter team: we won best allocation launch of 2018 award at

@ETFcom

! 🙏🙌 h/t

@CliffordAsness

@EconomPic

@Nonrelatedsense

@choffstein

@EricBalchunas

8

3

68

Good morning all!

Our friend

@RyanDetrick

published this great chart on small caps and odds for good returns ahead

July's rally was led by low quality small caps on rate cut hopes

We favor quality for navigating this cycle and over longer run. New blog

4

13

71

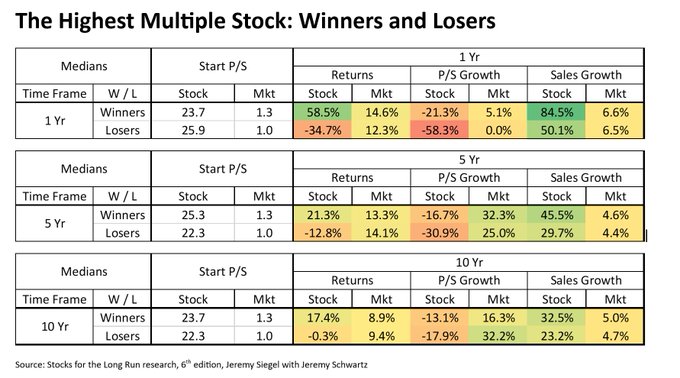

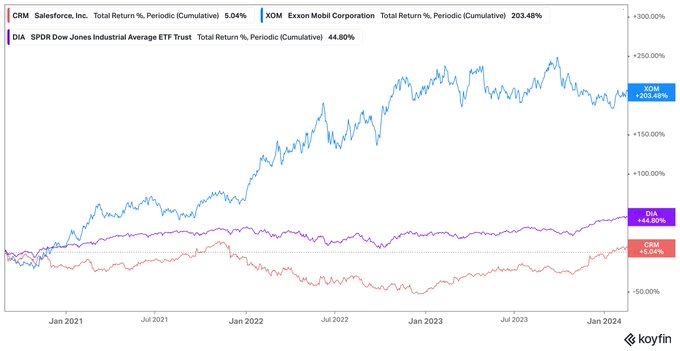

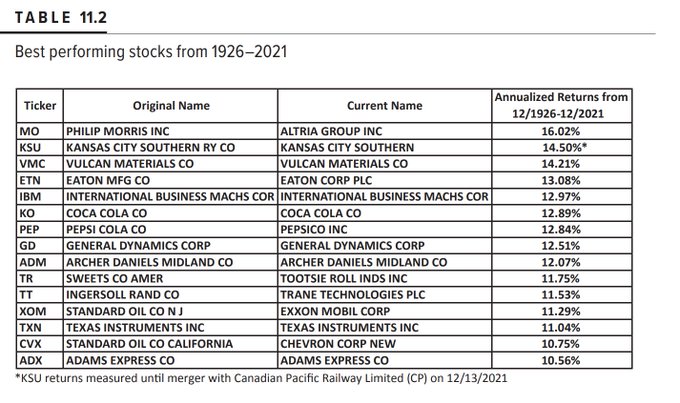

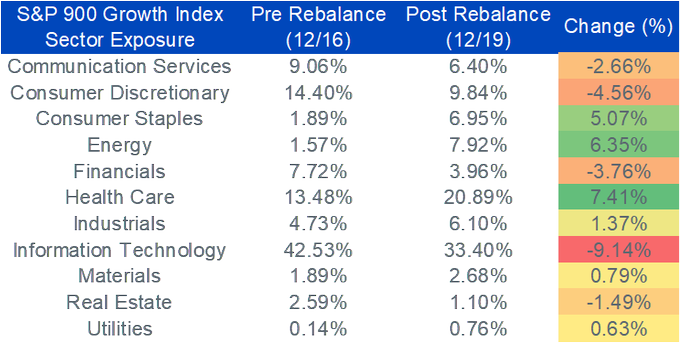

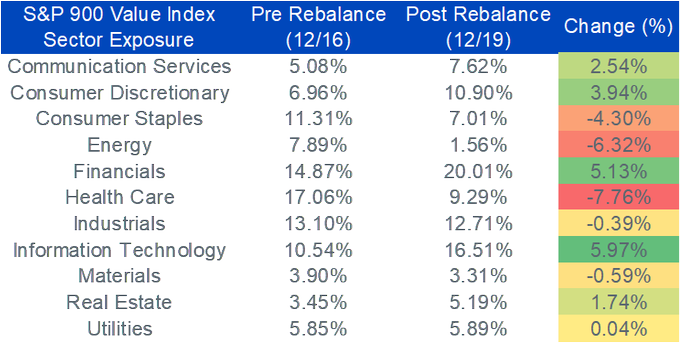

1/3

I was trained in the value school

@Wharton

, but if I were to make a case for growth stocks- the following combo of charts would be the story.

EPS Growth since 2020:

> 126% for Mag7 ;

>> 26% for S&P 500 ex Mag7

1

18

64

The after picture -approx 10 hours later. We made it! Proud of everyone especially my wife who I pressured into coming. Great time on trail with

@millerak42

@EricBalchunas

@preston_mcswain

#MFTF

3

4

59

What an honor to be first guest on inaugural ETF IQ show w/

@EricBalchunas

@scarletfu

-so proud of team here at BBG-Eric’s been working on this a long time!

2

7

59

@choffstein

Those 6m T-bills wont stay that high over longer run is what market is saying.

+ Stocks are real assets - over time earnings and dividends grow with inflation.

More important comp is vs 10-year TIPS yields and those are on par with averages...

6

4

56

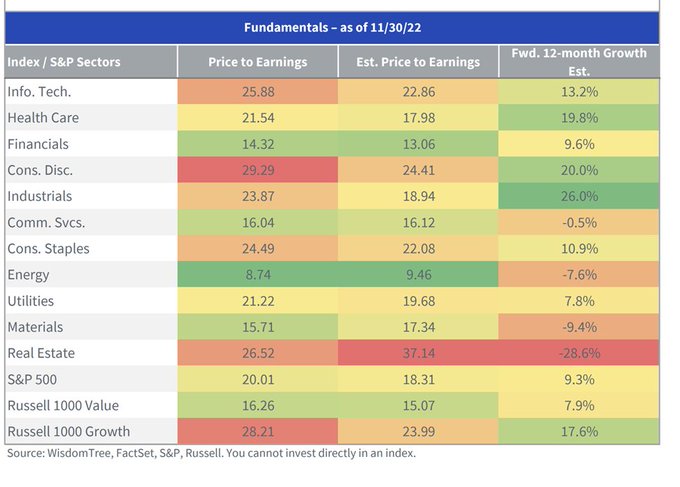

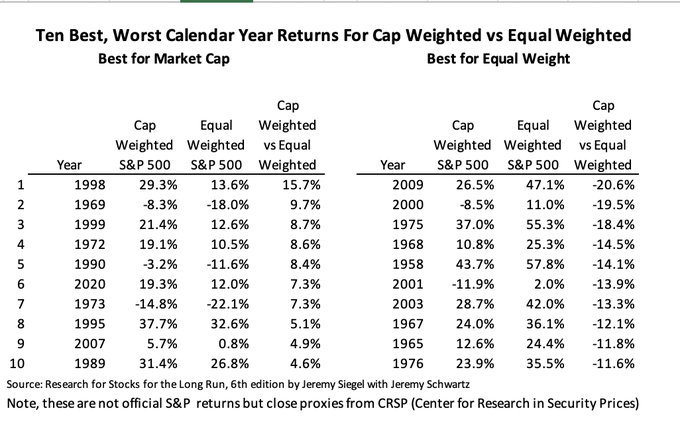

@WeLivetoServe

@cullenroche

@hmeisler

Some data from our archives on the difference between cap weighting and equal weighting going back to S&P 500 inception in 1957....

In last 65 full calendar years (1958-2022), market cap weighting beats equal weighting only 25 of last 65 years.

Relative return for cap vs equal

4

12

57

For those wondering how much training is minimum to make 28 mile march next yr: Bonnie didn’t train outside regular yoga classes. She showed up saying let’s see how far I can go & didn’t stop.

@MebFaber

crushed it with no training. It’s mental toughness. No excuses next yr :)

The after picture -approx 10 hours later. We made it! Proud of everyone especially my wife who I pressured into coming. Great time on trail with

@millerak42

@EricBalchunas

@preston_mcswain

#MFTF

3

4

59

4

2

54

Always enjoy listening to the Facts vs Feelings pod with

@RyanDetrick

and

@sonusvarghese

.

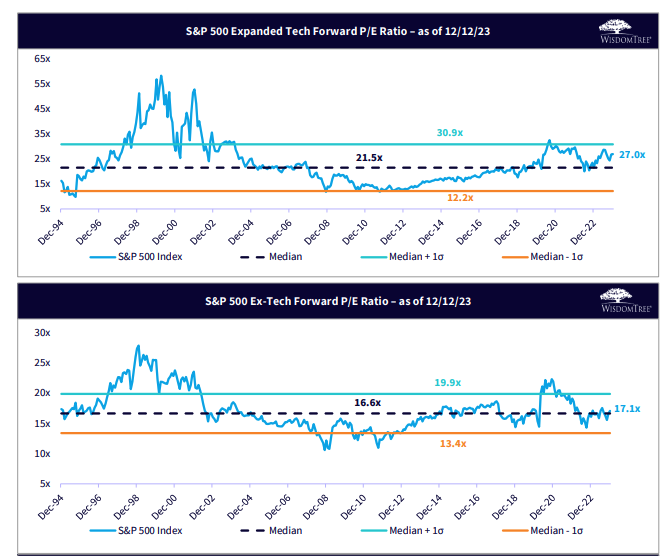

This week a special green episode on why This Isn't A Bubble.

We agree! Sonu shouts to our daily dash on tech vs non tech - link for daily updates below.

5

12

53

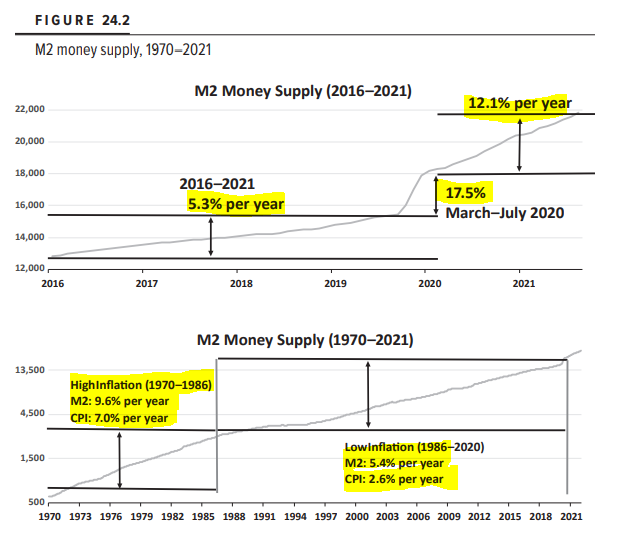

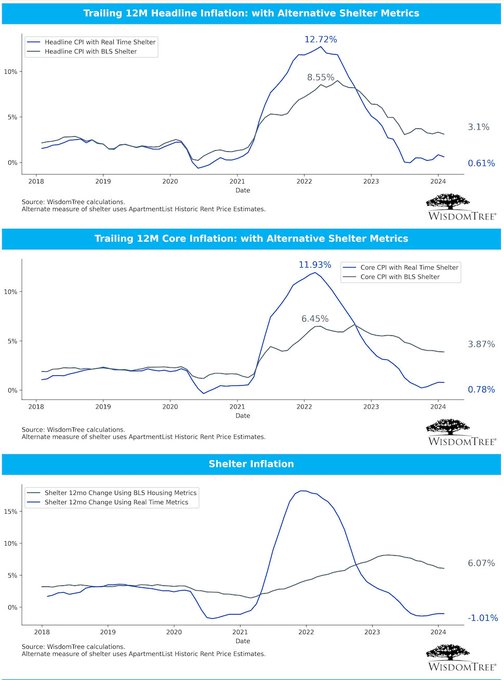

Siegel’s call for immediate rate cuts is NOT an indication of a Fed ‘panic’ like you all are saying. It is just being consistent with the Fed’s own Dot Plot and narratives.

Powell is being too deliberate and slow in not wanting to ‘surprise’ the market.

Below was the June Dot

10

9

52

Important personal and personnel news just crossed the wires.

@WisdomTreeETFs

added a new Director of Modern Alpha to our team this morning. Liqian Ren joins us from Vanguard where she ran their active factor funds. Very exciting development!

3

2

49

Thanks to

@CliffordAsness

for pointing out his ‘96 paper on the levered 60/40 - we updated his analysis work -the levered 60/40 worked better over following 25 years than during his original piece. Who said research never works out of sample!

2

2

47

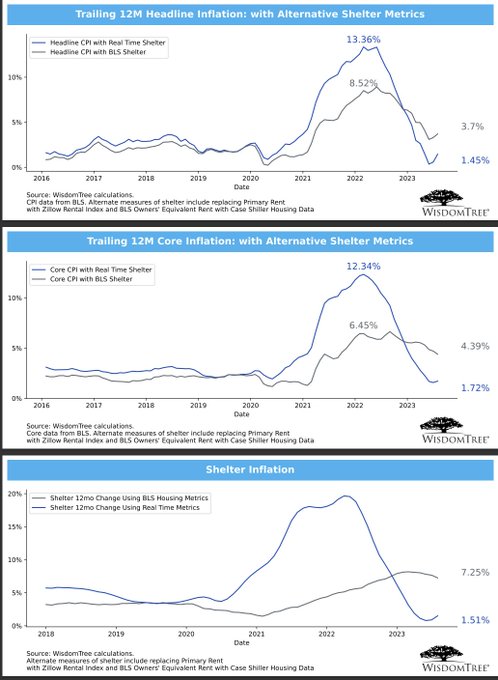

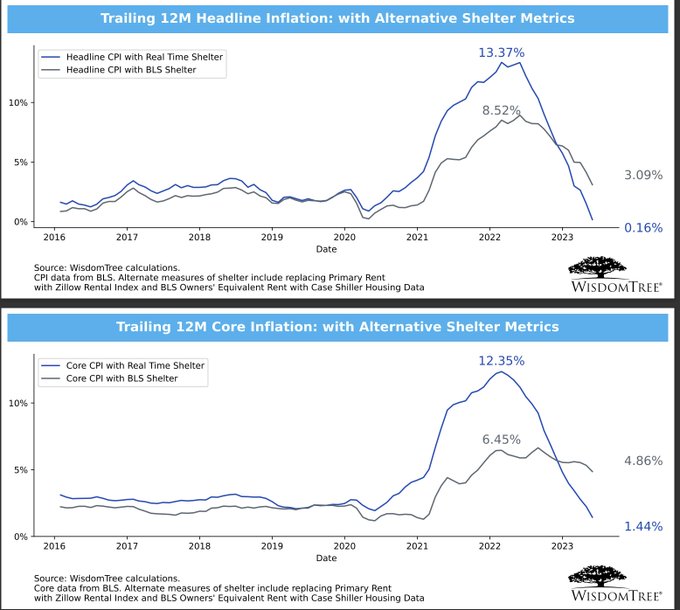

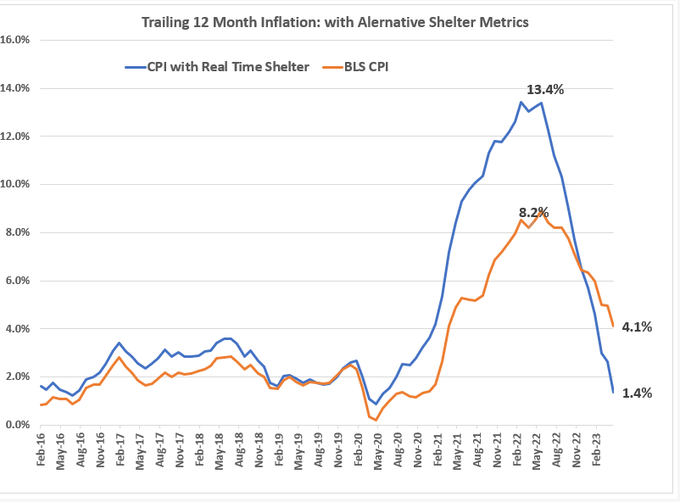

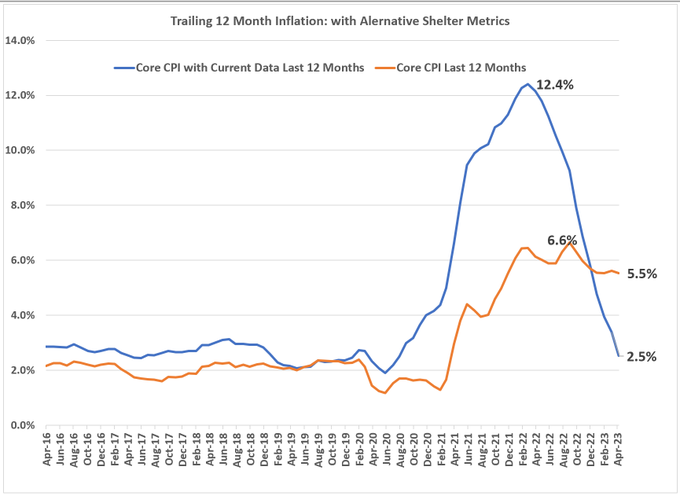

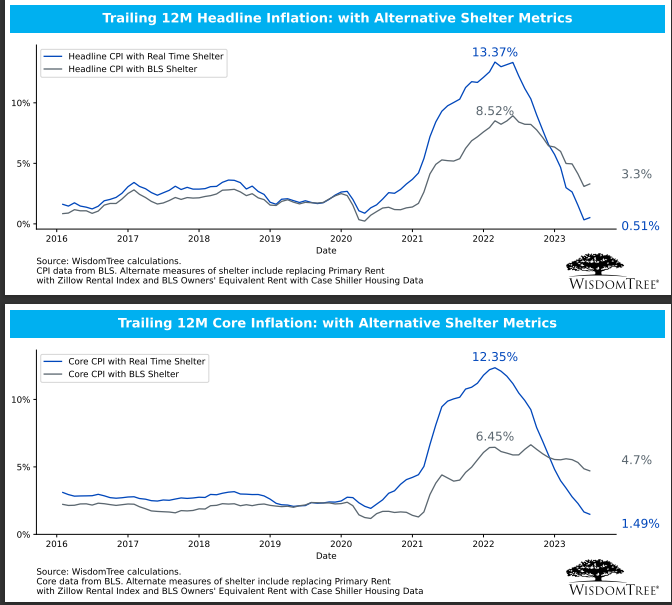

New all time low in

@truflation

alt and more real time cpi data.

Reinforces case Fed is behind the curve and should get to neutral quickly 👇

2

13

48

A little late but let me add to pile on of gratitude to

@CliffordAsness

for his work on how a levered 60/40 was better diversification than 100% equities alone from his 1996 paper. Real time stress tests of his paper 24 years post pub -results below! 💪

2

3

46

Behind the Markets w/

@profplum99

Chief Strategist, Portfolio Manager

@SimplifyAsstMgt

out now.

We get Mike's take on

1) The Economy - and how he has positioned the Macro Strategy he runs for Simplify

2) Volatility - How does 0dte options impact VIX and the term structure of

4

7

41

Got TIPS?

@biancoresearch

does via his new fixed income index.

5

7

42

🛢️: for a sustained move in oil

@WarrenPies

wants to see more than short covering of recession trades. Singapore crack spreads > $20 would signal better China demand.

@3F_Research

views on economy, markets, commodities and real asset allocation!

🔉pod

4

16

42