nextbigtrade

@nextbigtrade

Followers

38,681

Following

155

Media

3,815

Statuses

25,001

Trading High Potential Stocks Using Stage Analysis Premium Newsletter:

Joined January 2011

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Liam Payne

• 2061273 Tweets

Hobi

• 812025 Tweets

Bret

• 713121 Tweets

jhope

• 532671 Tweets

ブロック

• 329356 Tweets

Twitterくん

• 273847 Tweets

西田さん

• 134289 Tweets

西田敏行さん

• 123086 Tweets

俳優さん

• 107956 Tweets

Sabrina

• 106425 Tweets

#AgathaAllAlong

• 104380 Tweets

ツイッター

• 98152 Tweets

東京の自宅

• 67980 Tweets

ミュート

• 57113 Tweets

#OneDirection

• 51535 Tweets

イーロン

• 41526 Tweets

महर्षि वाल्मीकि

• 33628 Tweets

AI学習

• 29657 Tweets

ブルスカ

• 29163 Tweets

ぐりとぐら

• 22167 Tweets

中川李枝子

• 21937 Tweets

#INDvNZ

• 19924 Tweets

블루스카이

• 16303 Tweets

他のSNS

• 16299 Tweets

Bluesky

• 13523 Tweets

タイッツー

• 12717 Tweets

世田谷区

• 11914 Tweets

Last Seen Profiles

$CCJ biggest upside volume in the history of this leading

#uranium

stock last week. Note the change in volume as uranium has switched from a long term bear market to a bull market. The volume increase is a sign of institutions taking positions.

8

32

238

The big winners in 2020 were IPOs that broke out of Stage 1 bases

The big winners in 2021 were alt

#crypto

that broke out of Stage 1 bases

The big winners in 2022 were $XLE oil and gas stocks that broke out of Stage 1 bases

Notice a pattern?

18

31

227

$SLV Over 12 million shares volume so far pre-market and it's not even 8am ET yet. I don't think I've ever seen this type of pre-market volume before. $GLD $PPLT $PALL

#silversqueeze

9

39

220

$SLV Silver has a cup and handle pattern with volume drying up the last 2 weeks in the handle. Natural gas stocks just broke out big time from a similar pattern last week, will

#silver

be next? $GLD $GDX

9

28

174

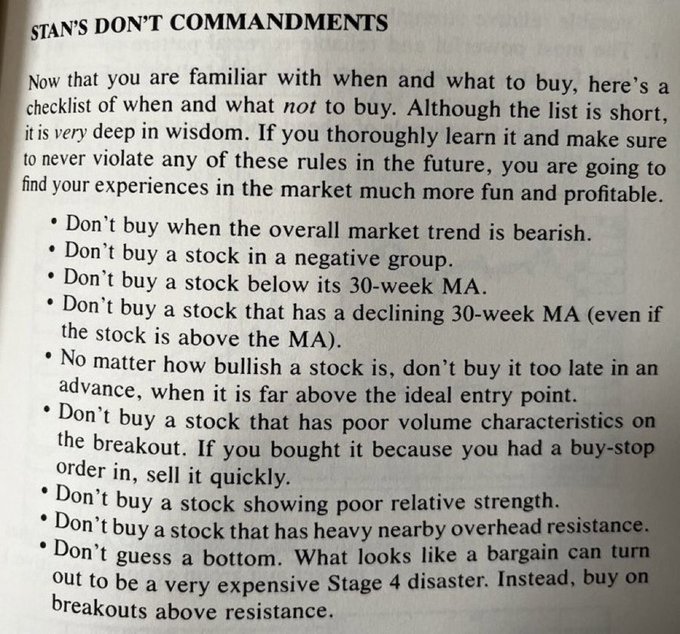

The human brain tends to become infected with greed at the end of a big Stage 2 run (see

#cryptocurrency

for current example) thus causing people to lose money after a bull market because they expect it to go on forever. Understanding Stage Analysis can help you overcome this

5

42

167