NEL 👨🏼🚀

@nellimkopi

Followers

8K

Following

13K

Statuses

7K

partnership & growth @skynettrading_ | prev: @nansen_ai minority shareholder of Hyperliquid $hype

Singapore

Joined October 2010

RT @0xMerp: Plan for the next 10 months is to increase two numbers Perps account PnL And staked HYPE Nothing else matters

0

19

0

RT @0xMerp: might actually end up holding HYPE multi cycle regardless of what BTC does the platform is great. a shitload of people use it…

0

16

0

RT @MessariCrypto: Hyperliquid’s monthly trading volumes up more than 4x since October Hyperliquid.

0

69

0

RT @defi_monk: 1) What's Next for Hyperliquid Key takeaways from my latest Messari report The market is still underpricing the implication…

0

239

0

that is a lot of words to say, Hyperliquid.

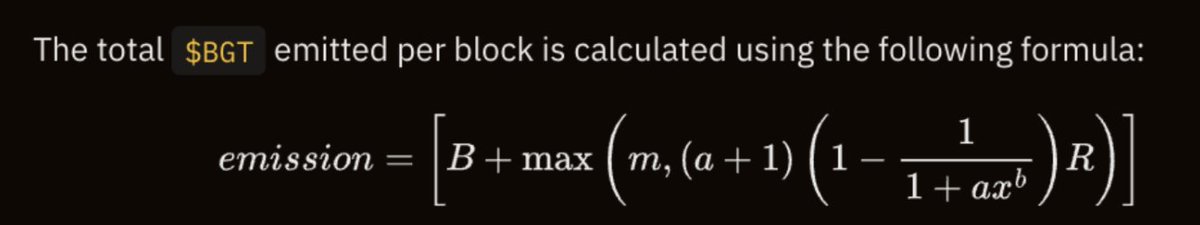

Crazy launch day. Being on the ground as Berachain comes to life is incredible- and celebrating it with the ecosysterm that cared for 3+ years is even better. Seeing a lot of confusion/misinformation today, so figured it was worth clearing up (long-form incoming): Concern One: Private BERA Stakers are getting the majority of BGT inflation, which then gets dumped by insiders. Yes, Private Investors do have the ability to stake their BERA. This is very different from a standard Cosmos L1 staking mechanism– like TIA. While the topline inflation number is similar, Berachain’s staking yield is comprised of two components: Base Staking Rate / Minimum BGT Block Reward - This is the minimum reward, which goes to BERA stakers (in this case, what private investors get). This is ~1.6% APR @ 10% network inflation (math below). The Majority of Staking Rate / Majority of BGT Block Reward - This is what goes to rewards vaults. NONE of this goes to private stakers. It goes to dApps and users that provide liquidity on the network. This is 8.4% APR @ 10% network inflation. BGT is as close to a fair launch token as you can get on a new L1 Blockchain, and plays the most important role of any asset in the ecosystem, but it doesn’t replace the immediate need for economic security (BERA stake) for a chain with > $3bn of TVL on Day One. Summary: For each BGT emitted, ~84% goes to ecosystem, ~16% to investors Concern Two: Berachain waited to launch to max value extract. Won’t spend time on this one, just a bad take. Anyone who has worked with the team at any point in time knows that we’ve been working hard to ship a chain for a while. Building an L1 is hard- especially one that is able to integrate unmodified EVM clients into a single-slot cometBFT consensus. Then add on top a custom economic architecture (PoL), and native dApps, and there’s a massive amount of surface area to cover. We’re also not even close to anything resembling a market top- Berachain launched into a massive Altcoin drawdown. Concern Three: Berachain launched perps instantly, so VCs could hedge their bags! Again, won’t linger here, as this is just an uninformed take from someone that doesn’t understand how funding rates work. Berachain has no control over which Centralized Exchanges launch Perps. On top of that, when funding is majorly negative (as it is now), an investor who wants to hedge $1m in exposure would have to pay $20m a year in funding to do so (at current rates). That’s obviously irrational. Concern Four: Berachain dropped a ‘small’ amount of tokens to the community! Berachain was born out of a Discord over three years ago. Since then, the original Bong Bear NFTs and their rebases have traded on the open market - available for anyone to participate on the same terms (or better!) than private investors got in at. Today, allocated 15% of total supply to the community - despite many of these folks being up massively in ETH terms already. An original Bong Bear Minter: - Spent 0.069e ($215) to mint a Bong Bear - Received 1 Bond Bear, 2 Boo Bears, 4 Baby Bears, 8 Band Bears, and 16 Bit Bears since then. - That basket of assets is worth ~$2m- which doesn’t include any of the other airdrops/value that was created for NFT holders over the past few years. These holders, whether day one or more recent, have been ardent supporters, buying into the culture and vision of Berachain. Whether or not you appreciate our vision- you should appreciate the culture and pain tolerance of a community to get to this point. Yes, rewarding folks for loyalty was something that we saw as important. Anyone who wanted to could’ve gotten exposure at any point in time. This was never a private-only, VC exclusive product. You just missed it. But guess what, in that time period we also onboarded over 200 dApp teams, who will take the massive portion of supply they’ve had allocated to them to pass along to new users, onboarding them into the Berachain ecosystem as well. Concern Five: Berachain has perpetual inflation! Yes, it’s a Layer One Blockchain. That’s how they work in most cases (barring old-school janky preminted rewards). Not much I can do about this. The vast majority of this inflation goes to the ecosystem, not to stakers. Concern Six: Berachain's entire "innovation" is that part of the inflation will be received by validators and part by chosen apps and LPers, which just means they need more inflation than otherwise to keep the chain secure if they're also going to incentivize users by giving them the token. No, not higher. Baseline inflation operates just the same as any other PoS chain. The biggest difference here is how value flows to users and dApps as the primary option. The way that validators get paid is through value exchange with applications, which normalizes demand for economic security (application & user demand) relative to provision for economic security (dollars staked). The ‘innovation’ as folks are so kindly putting it, is that by default value flows to the execution layer, to applications and users providing liquidity in the form of BGT. This helps normalize supply/demand for new block rewards. Take, say, a version of Berachain at $4bn FDV, with 10% inflation a year. That’s $400m of new issuance a year. If that went entirely to stakers- in the same way that every other chain operates, it would cause massive dilution, and then the foundation would have to FURTHER dilute to incentivize activity on the network level to justify the level of security active. Instead, on Berachain that $400m by default flows to applications and users providing liquidity to the network. Applications effectively determine their willingness to pay for block rewards (in either their Concern Seven: If BERA > $0, people will provide into whitelisted LPs to earn incentives, which insiders can dump into with unlocks. This is not how Proof of Liquidity works. The value generated from incentives toward whitelisted rewards vaults go to the BGT delegators- not to BERA stakers. The only way to acquire BGT (other than the minor base staking rate mentioned above), is to provide liquidity. As a result, liquidity providers that delegate BGT will always have meaningfully more BGT (and thus share of rewards) than any insider. You can think of BGT with a very simple cashflow-based framework. Relative to any chain without Proof-of-Liquidity, any amount of value in the form of incentives to delegates is necessarily recapture that doesn’t exist in any standard PoL-based system. If BGT inflation is 10%/year, incentives should grow at or above that rate in order to maintain equilibrium. This doesn’t have to be true over any specific short term period, but rather must be true over an extended period of time. Concern Eight: Only a small portion of the airdrop/unlocked amount is liquid, and there are meaningful supply overhangs remaining. All of the liquid portion of the NFTs is already vested, alongside the testnet component (RFA+General), Strategic Partners, Binance drop, and ecosystem NFT drop. Both ecosystem NFT drops and Testnet components were both set on genesis (already in circulation). The remainder includes NFT Vesting (over three years), RFB allocations (liquid, but STIP-style, designed to be used over 6-12 months), and Boyco (1-3 month unlocks). The only portion that remains outstanding and liquid is the Social Airdrop, which is only 0.25% of total supply. Some Extra BGT Math: Variables: - x = relative boost % - a = boostMultiplier = 3.5 (350%) - R = rewardRate = 1.5 BGT - m = minBoostedRewardRate = 0 - b = rewardConvexity = 0.4 The convexity of the rewards curve makes it so that most validators will emit 2.6 BGT/block to reward vaults on average. Base rate (to validators): - 0.5 BGT * 15,768,000 = 7,884,000 BGT/year Boosted rewards (to rewardVaults). This is ~15%. - 2.667 BGT * 15,768,000 = 42,053,256 BGT/year. This is ~85% - Total = 49,937,256 BGT/year Hyperliquid.

0

0

1

Except we think of Coinbase as a CEX that people have problems withdrawing funds out of. oh, and the hours long solana withdrawal.

If you think of Coinbase like a bank, we now hold about $0.42T in assets for our customers, which would make us 21st largest bank in the US by total assets, and growing. If you think of us more like a brokerage, we'd be the 8th largest brokerage today by AUM. If you think of us like a payments company…TBH i'm not sure where we rank on that list. There are various ways to measure it, but there were about $30T in total stablecoin payments last year (not all of those were goods and services though). The point is, with crypto the line between these categories is blurring. There are many legacy reasons these are separate in the traditional financial system - and not all of them are good reasons. Why does the money you spend lose value instead of growing in value like an investment? Why does your checking account not earn yield like a savings account (or better yet, like short term treasuries)? Many people use Coinbase to invest, but also to spend, get a loan, etc. In the updated financial system, you will have a single primary financial account which serves all these functions. A greater % of global GDP will run on more efficient crypto rails over time. We'll have sound money, lower friction transactions, and greater economic freedom for all.

1

0

5

RT @cobie: @TrustlessState Building something well-liked is not easy. It is not intended to be easy to launch something worth tens of billi…

0

43

0

RT @caitlinxyz: we're about to see the first example of a successful application-first chain GTM hyperliquid

0

38

0

lol who pays these guys for research when they can’t even form their thesis on proper data? Hyperliquid.

Thesis: - Super crowded trade - TVL is down 71% since peak, price is only down 32% - New user growth slowing down. - Hyperliquid user base is getting poorer. - Avg crypto enjoyer just got a lot poorer after last week. - Rollbit also had buybacks and it didn't matter. - Fat bear flag for those who believe in drawing lines on charts. - $25B FDV, lot of uPNL to flush. The most bullish people on HYPE I see are hoping for a 2x - 3x. Didn't size huge, don't take shorts often. Will be fine if I'm wrong.

0

0

1

RT @wronguser000: $HYPE prob one of the few assets you wanna just throw money in and not touch until the inevitable run to 50+ USD Thesis…

0

106

0

RT @murtaza: Berachain. Monad. Scroll. Blast. All will have the same faith, watch the chart for last 2. Feels crazy to me that there was…

0

18

0

RT @Keisan_Crypto: Hyperliquid just hit an ATH in inflows of $2.5Bn. This is +$470M since the beginning of the year, averaging about $13M o…

0

13

0

RT @AlexSmirnov__: I’m now fairly convinced @HyperliquidX szn is only just beginning. The % of transfers to Hyperliquid has been increasin…

0

46

0

RT @smartestmoney_: You thought the Long $HYPE // Short Everything thesis was a joke. Higher liquid.

0

25

0

RT @karl_0x: until 2027 the equivalent of half of all $USDT in circulation worth of altcoins will be unlocked ($70b) long $HYPE / short ev…

0

25

0

RT @Ren_gmi: The majority of crypto hedge funds & especially more traditional hedge funds / VCs are not yet able to buy and custody HYPE du…

0

19

0

RT @SplitCapital: As it currently stands, $HYPE does nearly $200 million in daily spot flow on @HyperliquidX, which would place it in the t…

0

28

0

RT @ThinkingUSD: Hyperliquid Volume Growth Metrics past few months: Nov: +130% Dec: +108% Jan: +30% Is there a faster growing asset in Cr…

0

26

0